Difference between revisions of "Kiva"

| Line 13: | Line 13: | ||

== <small>'''Description'''</small> == | == <small>'''Description'''</small> == | ||

| − | Kiva | + | Kiva is a nonprofit platform promoting personal and family initiatives, projects and small businesses by crowdfunding microloans. The platform was created in the US in 2005, committed to alleviating poverty through social change by supporting projects started by people in vulnerable groups, such as low income families or other marginalized groups. The platform also offers a program to empower family and communities through education, business counselling and information on health and wellbeing. |

| − | Kiva | + | Kiva works through loans provided by a network of supporting institutions and individuals who contribute with as little as $25 dollars. A project creator’s network of friends and family is also a very important source of support. In order to obtain a loan from Kiva, applicants submit a project that will go through an assessment to determine if it meets certain values and requirements. Once the project has set a funding goal and deadline, it can be uploaded to the website and start campaigning. |

| − | + | Projects looking for support must fill a profile stating their goals and providing a description with images. To help projects meet their funding goal before a deadline, loans provided by individual backers can be met, doubled or tripled by partner institutions. | |

== <small>'''Links'''</small> == | == <small>'''Links'''</small> == | ||

Latest revision as of 01:10, 3 June 2017

Self-portrait

We envision a world where all people hold the power to create opportunity for themselves and others.

Kiva is an international nonprofit, founded in 2005 and based in San Francisco, with a mission to connect people through lending to alleviate poverty. We celebrate and support people looking to create a better future for themselves, their families and their communities.

By lending as little as $25 on Kiva, anyone can help a borrower start or grow a business, go to school, access clean energy or realize their potential. For some, it’s a matter of survival, for others it’s the fuel for a life-long ambition.

100% of every dollar you lend on Kiva goes to funding loans. Kiva covers costs primarily through optional donations, as well as through support from grants and sponsors. (https://www.kiva.org/about)

Description

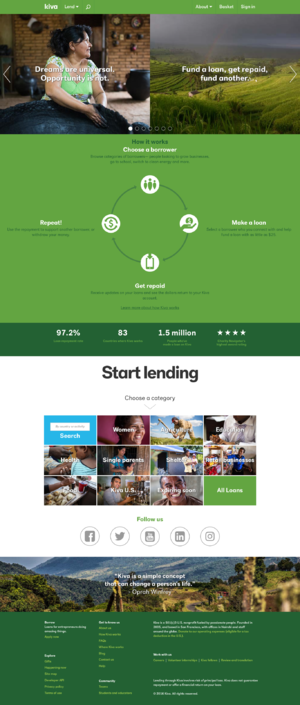

Kiva is a nonprofit platform promoting personal and family initiatives, projects and small businesses by crowdfunding microloans. The platform was created in the US in 2005, committed to alleviating poverty through social change by supporting projects started by people in vulnerable groups, such as low income families or other marginalized groups. The platform also offers a program to empower family and communities through education, business counselling and information on health and wellbeing.

Kiva works through loans provided by a network of supporting institutions and individuals who contribute with as little as $25 dollars. A project creator’s network of friends and family is also a very important source of support. In order to obtain a loan from Kiva, applicants submit a project that will go through an assessment to determine if it meets certain values and requirements. Once the project has set a funding goal and deadline, it can be uploaded to the website and start campaigning.

Projects looking for support must fill a profile stating their goals and providing a description with images. To help projects meet their funding goal before a deadline, loans provided by individual backers can be met, doubled or tripled by partner institutions.

Links

URL: http://www.kiva.org/

Wayback Machine: https://web.archive.org/web/*/http://www.kiva.org/

Wikipedia: https://en.wikipedia.org/wiki/Kiva_(organization)