Diferencia entre revisiones de «2019 - The long-term Bitcoin investor manifesto - Gerard Martínez»

(Página creada con «miniaturadeimagen|derecha == <small>'''Texto'''</small> == In this short rule list I want to share with you (and...») |

|||

| Línea 59: | Línea 59: | ||

[[Categoría:Manifiestos]] | [[Categoría:Manifiestos]] | ||

| − | [[Categoría: | + | [[Categoría:Criptomoneda]] |

[[Categoría:Gerard Martínez]] | [[Categoría:Gerard Martínez]] | ||

[[Categoría:2019]] | [[Categoría:2019]] | ||

Revisión del 01:21 10 ene 2022

Texto

In this short rule list I want to share with you (and my future self) few opinionated lessons I learned the hard way since I bought my first Bitcoin at the beginning of 2018. This post is dedicated to all those long-term investors and traders of Bitcoin and altcoins. If you are still unsure about the potential of the technology and you are here to make a quick buck, this list is not for you. This is not a definitive list and (I hope) it will be revised for the better as we learn more about the space and the cryptocurrency mysteries start to unravel.

Rule 1. You can’t beat parabolic growth: join it

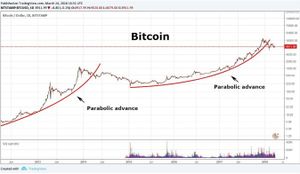

Bitcoin is one of the few assets (if not the only one) that has witnessed several bull runs of parabolic growth during its course of history. A parabolic growth is a type of growth in which the prices increasingly accelerate resembling a parabola, a type of curve in mathematics.

When the market is witnessing a bull run, the growth is of a such magnitude and volatility that is extremely hard to outsmart the market by trading it against fiat (USD dollar, Euro, etc.) using regular longing and shorting. This doesn’t mean it can’t be done. This doesn’t mean you won’t make money by trading it against fiat. I actually did and many others did. What this means is that 95% of us would not be able to beat the gains obtained by a simple “holding strategy”.

There are couple of exceptions to this rule: leverage trading and automatic (bot) trading. Traditional trading is about sitting down and analyzing the charts to find profitable opportunities. While Bitcoin remains a mystery to most of us most of the time, there are few situations in which certain patterns hold an amount of predictability that can be effectively exploited using leverage trading, which multiplies the gains that could be achieved by regular trading. Beware, however, of the high risks involved in leverage trading. While in regular trading you are risking few percentages with the right stop losses, in leverage trading you can loose it all. Finally, I don’t exclude the possibility that an automatic trading algorithm, specially in the high-frequency regime, could actually beat a human and the market if it was effective enough.

Rule 2. Use fiat only to buy more Bitcoin

If you believe in Bitcoin in the long term, store your value in Bitcoin. Forget about fiat and trading against fiat. The moment you do that wire transfer and buy Bitcoin, the fiat is gone for good.

The first reason why you should do it is due to the rule number 1. Remember: you can’t beat parabolic growth so make sure you join the gains.

Another reason is that you may be exempted in terms of taxes if you hold and trade only between cryptocurrencies. This varies depending on the country you declare taxes in. Check your laws.

Additionally, exchanges such as Binance only deal with cryptocurrencies and offer interesting advantages respect other exchanges such as very low trading fees (as low as 0.075% for both taker and maker orders).

Finally, you will sleep better because you won’t have to wake up in the middle of the night due to alerts or stop losses. See: you no longer chase Bitcoin’s price. One Bitcoin is one Bitcoin regardless of the fiat price

Rule 3. Accumulate on bear markets

In Bitcoin, parabolic growths — or “bull runs” — alternate with “bear markets”, in which the price decelerates and corrects before starting a new bull run. Therefore, Bitcoin displays a clear seasonality.

You have probably heard the fact that when the market is in bear mode, one must “accumulate”. While is true that the fiat value of cryptocurrencies strongly decays during bear markets, it is also true that the price of these assets becomes undervalued. If we hold a long term vision and we are able to effectively abstract ourselves from the market irrationality, a bear market is essentially a rebate, a discount for a good product such as the ones we can find on post-Christmas sales. Accumulation therefore means to maximize the absolute number of cryptoassets regardless of the current fiat value.

The problem, however, is spotting the right moment to buy. Is the asset enough undervalued? Will it go lower? A solution to this problem is following a strategy called dollar-cost averaging. An example of this strategy is buying 200 Euros of Bitcoin every month. You decide how much you want to invest and the regularity with which you want to do so. The whole point is to really stick to the strategy you choose. Some people have suggested variants to this strategy such as buying proportionally to how much an asset value has depreciated. For instance: did Bitcoin fall 10%? Then I buy 10% more, and so on.

Rule 4. Maximize bitcoin by trading altcoins against bitcoin (BTC)

The growth of altcoins is extremely correlated with the growth of Bitcoin (with few exceptions such as Binance Coin, which was recently doing great while Bitcoin was sinking). In other words, shall Bitcoin fail and all the altcoins would fail with it. This makes sense since Bitcoin is the mother of all cryptocurrencies, and therefore if it fails to deliver the expected promises it is hard that any other crypto would do.

However, it is well known that once Bitcoin stabilizes (usually after a heavy rally up) altcoins explode in value as people sell their BTC for altcoins. This is an excellent opportunity to trade and maximize the absolute amount of Bitcoin we hold. While is true that all cryptocurrencies are somewhat correlated, there are hundreds of different markets each displaying its particular chart pattern formations. Having such a variety of markets is a very good feature for traders since there’s plenty of space to explore and search for profitable opportunities.

If we follow rule number 4, we will try to exploit these opportunities by trading always with BTC as base symbol simply because we don’t deal with fiat anymore in agreement with rule number 2 (and possibly not with stable-coins either). Additionally, since most altcoin prices move in correlation to Bitcoin, the volatility of cryptocurrencies paired with Bitcoin is usually much lower, which reduces the trading difficulty and charting techniques such as price action play nicely.

But how actually will you place your trades depends on the kind of trader you are. Do you have the stamina for medium-term trading? Then you can go for trades that can last few days. Do you really value your time independence and you want the freedom to decide when and how long you want to trade? Then probably short-term and intra-day trading is for you. The whole point is that by trading using BTC as the base crypto, you no longer have to “chase” the Bitcoin market and you can choose to trade whenever you want and for the duration you want (in my case short sessions). By following this strategy you can achieve a twofold objective: (1) you can ride the gains of a parabolically growing asset (Bitcoin) and (2) you can maximize the absolute number of BTC by trading whenever you want and for as long as you desire according to your objectives.

This project is part of our research at CryptoDatum.io, a cryptocurrency data API that aims to provide plug-and-play datasets to train machine learning algorithms. If you are a machine learning practitioner, get your free API key and play with them yourself at https://cryptodatum.io

Enlaces

Primera edición:

URL: https://medium.com/coinmonks/the-long-term-bitcoin-investor-manifesto-afbc137d78ff

Wayback Machine: https://web.archive.org/web/20190701162427/https://medium.com/coinmonks/the-long-term-bitcoin-investor-manifesto-afbc137d78ff